In brief: The tech supply chain is still coping with the perfect storm of factors that has led to jammed up ports and severe bottlenecks in the flow of raw materials and components needed to build products with electronics inside. Production slowdowns in China and other Asian countries due to energy restrictions and Covid-related lockdowns are already impacting suppliers of passive electronic components and chips, but some are hopeful about their ability to navigate the coming months without any major disruption.

By now it’s no secret the tech supply chain is experiencing the cascading effects of material, component, and shipping container shortages, as well as increased energy prices, Covid-related factory lockdowns, rapid shifts in environmental policies, unrelenting demand for electronics and semiconductors, the rapid digitalization of companies and public institutions around the world, and a slew of other factors.

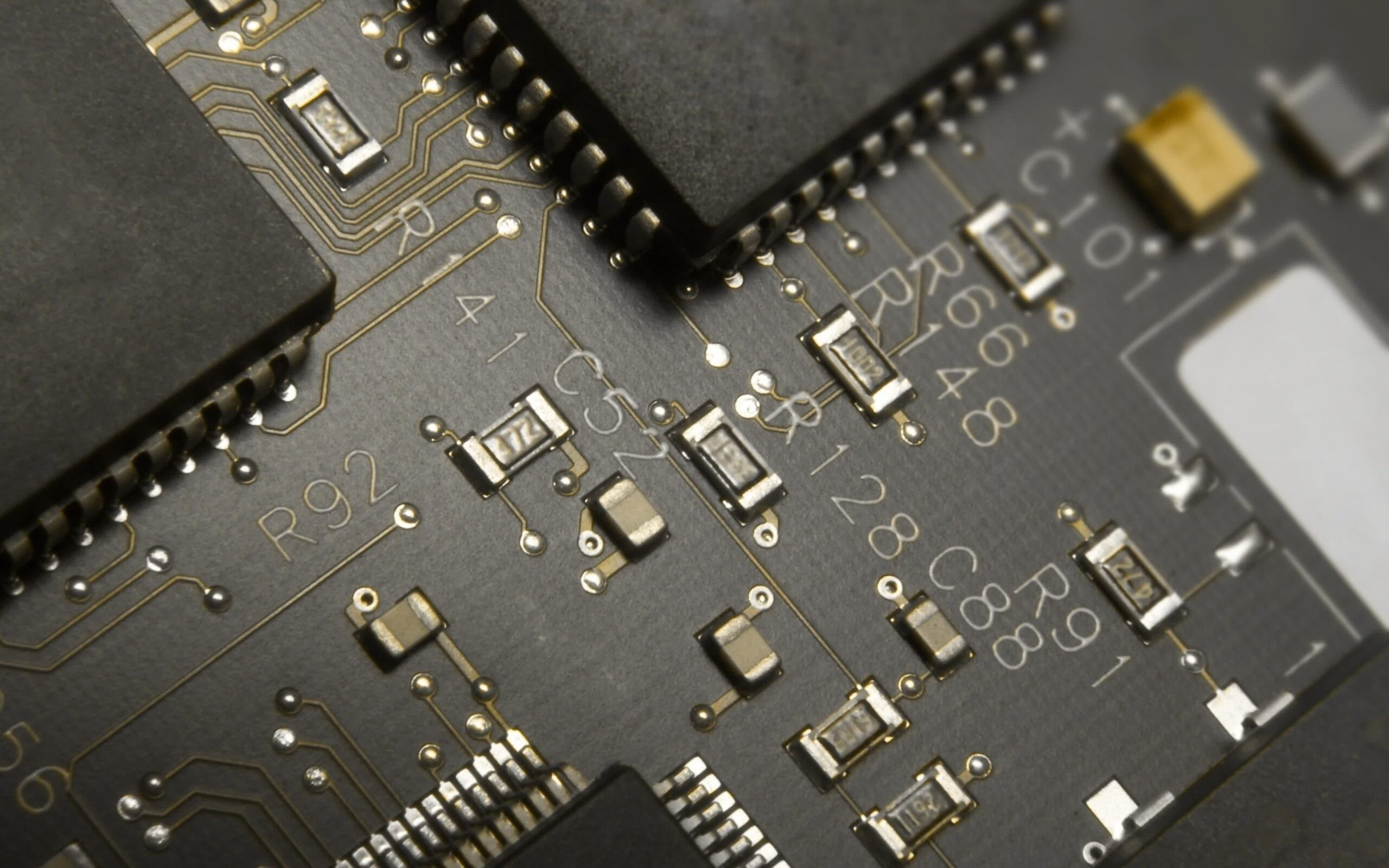

The chip shortage has been a lot more prominent in the news over the past year, but other essential components have also been in short supply. Passive electronic components like resistors, capacitors, and inductors were already a bit hard to come by in late 2020, and the situation could get worse towards the end of this year.

Back in December, Walsin Technology reopened its manufacturing plant in Malaysia after several disruptions related to lockdowns in the region. However, just one month later, a fire hit Taiwanese’s multilayer ceramic capacitor (MLCC) factory in Dongguan, China, raising concerns around the supply of MLCCs and chip resistors.

By April, those fears had mostly been put to rest. Large passive component suppliers like Yageo, Walsin Technology, Chilisin Electronics, ABC Taiwan Electronics, and Tai-Tech Advanced Electronics were optimistic about their ability to supply passive components for their clients in the second and third quarters, with capacity utilization sitting at around 80 to 90 percent.

Fast forward to August, and renewed lockdowns in Asia were yet again threatening production of passive components. Last month, the effects of the summer restrictions came into focus as Japanese suppliers of aluminum capacitors were forced to operate at a greatly reduced capacity and lead times skyrocketed to more than six months.

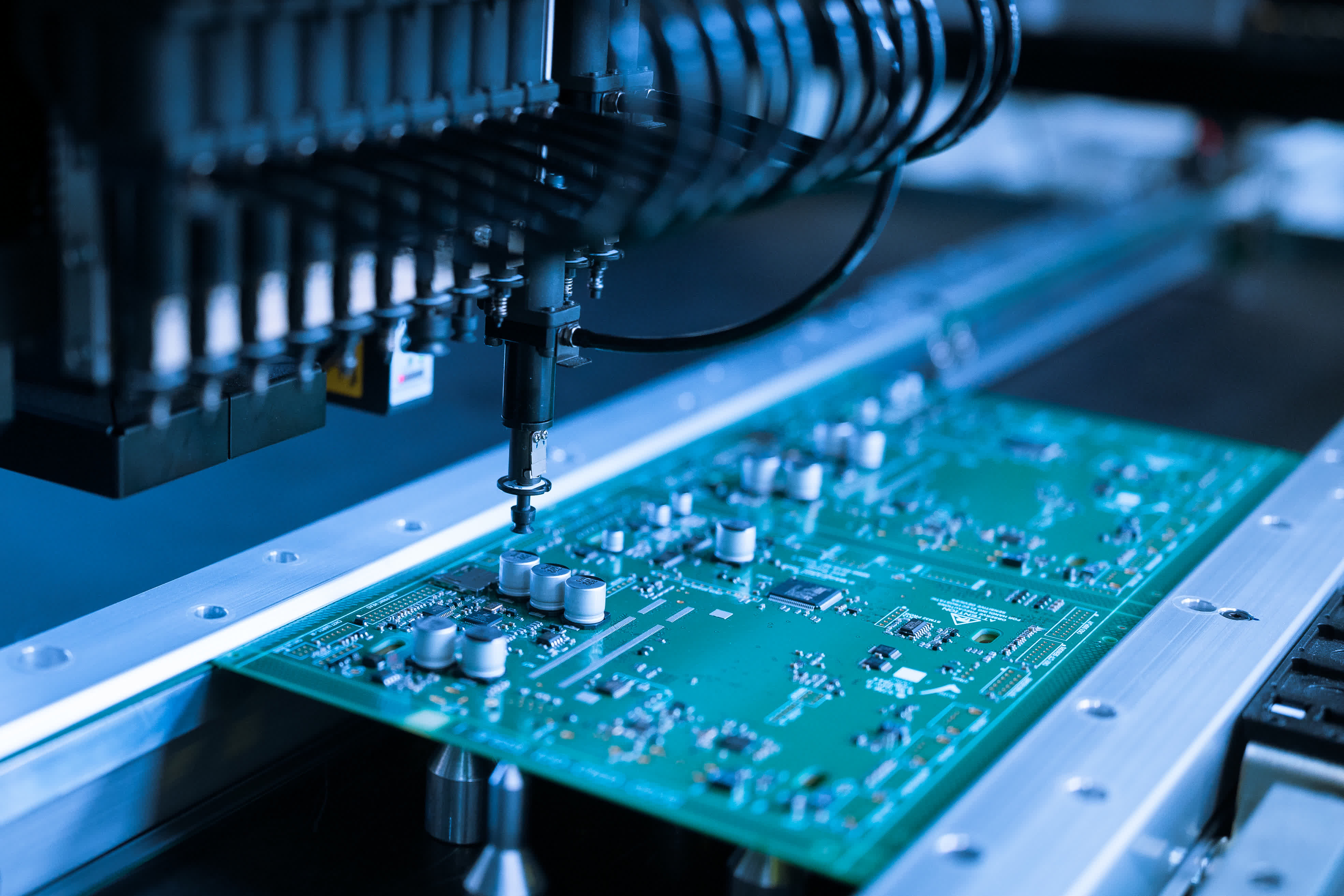

Towards the end of September, China implemented an energy crunch that forced several suppliers for tech giants like Apple, Tesla, and Qualcomm to reduce or even halt production. As we enter the fourth quarter, Taiwanese companies are concerned about these disruptions, and the most optimistic among them expect to, at most, maintain the current level of production throughout the rest of the year.

For instance, Yageo believes it will be able to satisfy demand for MLCCs from automakers and other industrial clients, as its factories are located outside of the areas in China that have been subjected to power cuts. At the same time, Walsin’s progress on building a new plant in Kaohsiung, Taiwan, is well underway, which is going to aid the supply of MLCCs and chip resistors in the coming months. This is good news for automakers in particular, which have been the hardest hit industry so far.

Image credit: Andrey Metelev

However, China’s aggressive power cuts still have the potential to create problems, as we’ve seen with the massively reduced output of high-purity silicon from the region. This has sent prices through the roof compared to just a year or even a month ago, and the same happened for rare earth metals and other raw materials like copper, tin, aluminum, and cobalt, which are used for chip packaging, mounting and connecting electronic components on printed circuit boards, and more.

Some suppliers will be able to take a hit on their profit margins, but most will feel compelled to hoard components and raise prices, which in turn could lead to higher retail prices for all electronics as soon as next year. Coupled with an acute shortage of skilled workers, this could have ripple effects on several industries. The cherry on top is a shipping crisis that will make this year’s holiday shopping season a nightmare for people who don’t plan ahead or are unwilling to consider locally-produced goods.