- The Dow Jones rallied strongly ahead of Tuesday’s presidential election as early voter turnout breaks records.

- There’s evidence of “blue wave” bets in the stock market as cannabis and solar ETFs outperformed.

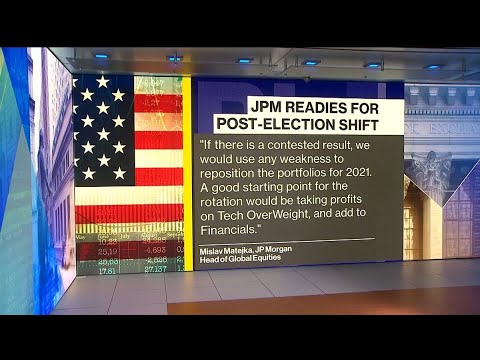

- JPMorgan knocked Dow giants Apple and Microsoft after shifting to neutral on tech.

The Dow Jones rallied 250 points on Monday, as Wall Street gears up for the election on November 3rd. Big rallies in oil, cannabis and solar indicate blue wave bets for Joe Biden, while tech-sector struggles were seen after a major rating change from JPMorgan’s investment team.

Dow Jones Rallies on Blue Wave Bets

Among the major U.S. stock market indices, the Dow Jones was the strongest, as the S&P 500 rallied 0.6%, and the Nasdaq dropped 0.3%.

Impressive economic were seen in the world’s two largest economies, as both U.S. and Chinese manufacturing PMIs comfortably beat forecasts. Signs of such strength appeared to help lift stock markets, as a wave of risk-on bets flooded into certain sectors.

Watch the video below for the latest on record early voter turnout in the United States.

It might appear surprising that traders are prepared to make big bets the day before an election, but with turnout booming in Texas and Florida, it seems like the bulls are betting on a resounding victory for Joe Biden.

Turnout is often a strong indicator of how the Democratic candidate is performing, and with mild weather forecast, the outlook favors long lines on election day.

Outperformance from cannabis and solar stocks was perhaps the clearest evidence of blue-wave optimism.

If the polls are incorrect, a Trump victory can cause considerable shockwaves against current market positioning in the Dow Jones. Investors’ greatest concern is probably not a red wave but an election that’s too close to call.

Should neither Biden nor the White House positively declare victory, weeks or even months of legal contests could be ahead. Economists at ING believe that the state of the pandemic only worsens the outcome if there is no clear winner:

Should the election fail to deliver a clear result and recounts and legal challenges mean that there is a longer period of uncertainty, market angst would likely rise, particularly given sharply rising Covid-19 hospitalisations and the potential for more containment measures. It would also end up heightening animosity between the two parties and could make getting legislation through Congress more challenging if grudges are allowed to fester.

Dow 30 Stocks: Apple and Microsoft Slip Amid Rally

It was a very positive day in the Dow 30, as the vast majority of the index enjoyed a strong performance. Tech giant Apple was not one of these, as it fell 0.6%. Microsoft was also under pressure, as it lost 0.8%.

Fueling this decline may have been a significant note from JPMorgan, where the investment bank indicated that it was now cutting from its “overweight” position in tech stocks, a significant change from its previous stance.

Watch the video below for a full breakdown of the investment bank’s shift to neutral.

Dow Inc. and Honeywell lead the Dow Jones with gains of more than 4%, while Caterpillar was also a strong performer with a 3% gain. Chevron group gained 3.5% as the price of crude made up some of its overnight losses.